Pay Off Credit Card vs Money in Savings – Which One First?

If you have a lot of credit card debt and little to no savings, you may be wondering which one to prioritize – paying down debt or saving money.

Hi there, I'm Annie Zhou. Over the last few years, I've worked at several early stage startups in various functions from marketing to business operations to product. I'm also a licensed real estate professional, specializing in the San Francisco real estate market, and run a personal finance blog at Finance Futurists with some friends where we talk about all things finance-related, including stocks, crypto, credit cards, budgeting and more.

Out of the office, you will find me reading, running, trying new restaurants, attempting to learn Korean, and learning how to code in some combination.

Finance Futurists is a personal finance blog made to provide educational insight for Gen Zers and Millennials looking to improve their financial knowledge.

Sign up for our weekly newsletter.

A curated selection of articles I've written on stocks, credit cards, web3, budgeting, and more.

If you have a lot of credit card debt and little to no savings, you may be wondering which one to prioritize – paying down debt or saving money.

Web 3.0 is the next generation internet and has just started its development. There are several ways for investors to make a direct investment in web3.

Medium-term goals fall under a gray area between short-term goals and long-term goals. But, they are critical for helping you stay on track to accomplish your long-term plans.

Simplify your planning and budgeting process with these best practices.

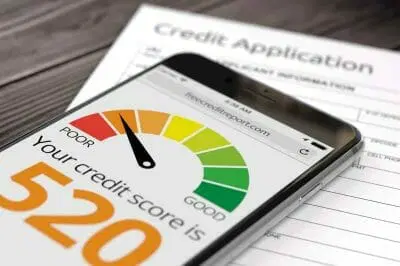

Improving your credit score can take months or years, but there are a few actions you can take to see immediate jumps in your score.

When it comes to the stock market, there are two popular methods that are broadly used by investors and traders: fundamental analysis and technical analysis.

While sinking funds and emergency funds have some overlap, the difference between a sinking fund and an emergency fund lies in their intent and purpose.

Credit can be an invaluable tool in wealth creation when leveraged constructively.

Bitcoin is the first and most valuable coin to enter the cryptocurrency scene. You can buy Bitcoin in four easy steps through a centralized exchange or a peer-to-peer platform.